Rumored Buzz on Paypal Business Loan

Wiki Article

Our Paypal Business Loan Diaries

Table of ContentsThe Greatest Guide To Paypal Business LoanPaypal Business Loan - QuestionsThe Main Principles Of Paypal Business Loan Fascination About Paypal Business LoanPaypal Business Loan Fundamentals ExplainedPaypal Business Loan - The Facts

Several company proprietors report sensation emphasized when looking for a little business loan. It seems that lenders are requesting a growing number of documentation with each passing day. Actually, the majority of lenders have a conventional discovery list of files that are called for to request as well as refine a lending. PayPal Business Loan. Understanding which records will certainly be called for and also obtaining that documents in order before you make an application for your business financing can minimize your stress as well as speed-up approval of your car loan.Be prepared to supply as much as 2 years of history. Not all lending institutions will certainly call for two years on all records, however numerous will not call for more than that. PayPal Business Loan. In any instance, be prepared to equip all requested documents.

The smart Trick of Paypal Business Loan That Nobody is Discussing

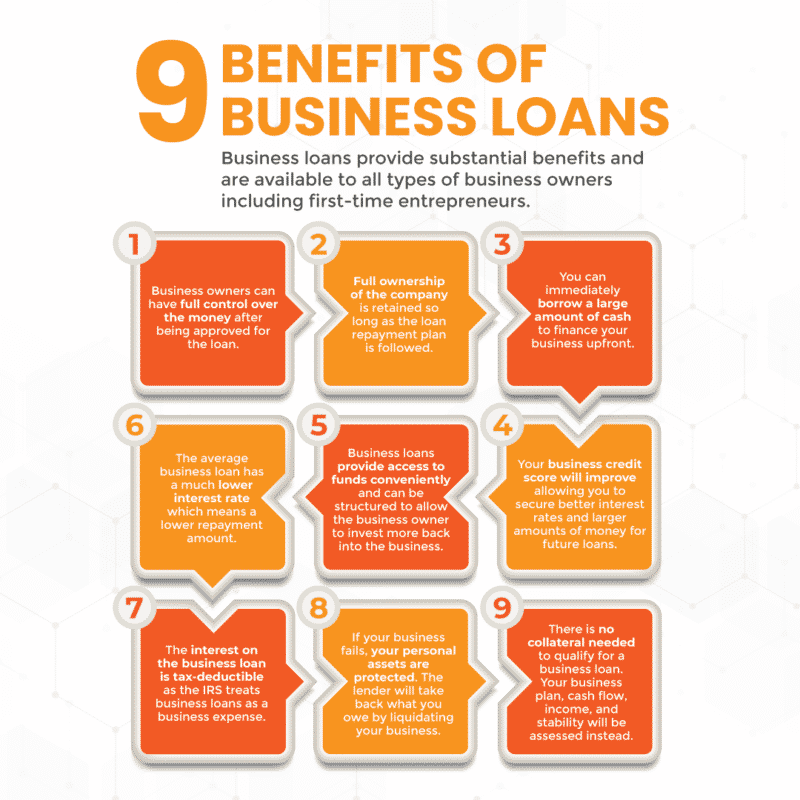

Yet you can choose from a variety of business lending types and must investigate your options to discover the finest fit. Consider the kinds of small-business finances you can select from: SBA fundings. The SBA partly backs finances from providing companions, reducing their threat and also improving accessibility to capital for small organizations.

Tools funding is a kind of term car loan that can be used to purchase and expand the price of equipment or tools for your organization. Generally, the tools is security for the financing. If your tiny organization has problem with money flow because you're waiting on invoices to be paid, you can make use of invoice funding, also referred to as factoring.

The Ultimate Guide To Paypal Business Loan

Specific energy-efficient or making jobs might qualify for more than one 504 car loan of up to $5. Organizations might utilize catastrophe lendings to fix or replace machinery and devices, supply, and also real estate that was damaged or damaged.Many small-business fundings can be used for a selection of organization demands. Considerable documents called for. Small-business funding applications can call for a lot of documentation, which may make the process lengthy. Minimal choices with negative credit. Small-business loan applications are based partly on credit scores, and also there are couple of car loan alternatives for organizations with negative credit history.

Some on the internet lenders are considered different lenders, which can provide more adaptability than industrial banks because their lending items are much less controlled. Alternative lenders give loans to debtors that or else might not have access to small-business financing, such as startups or services with an unstable financial background."Small companies need to know there are multiple networks offered for borrowing required funds," says S.

Unknown Facts About Paypal Business Loan

Online lenders might provide SBA lending programs. You can likewise locate peer-to-peer lenders online that will connect your small business with capitalists eager to money click here now your lending. Dimension alone won't be sufficient to get a small-business lending. You need to persuade the lending institution that your company deserves the threat.You could get a different loan for pay-roll than you would certainly for genuine estate. If a loan provider doesn't offer loans in the amount you need, discover one that will. Working out for a reduced quantity could burden you with a funding that falls brief of properly resolving your funding demands.

Paypal Business Loan - An Overview

Temporary company loans have greater regular monthly payments than lasting car loans, but you will commonly pay less in overall interest since you have the funding for much less time. The opposite is likewise real. A longer repayment term can mean lower regular monthly payments but even more in complete interest charges over the life of the finance.Try to find a lending read this institution with the most affordable prices, including: The annual portion price is the passion billed on your car loan annually, plus all costs and also prices connected with the finance. Maintain in mind that marketed interest prices may be where rates start; a rate check can estimate an APR for your small-business funding.

Down repayment demands vary, but expect to invest at least 10% to 30% of your very own capital when taking out a loan. An aspect price is normally made use of for vendor cash advances as well as short-term business loans to establish exactly how much you will certainly owe in passion.

Everything about Paypal Business Loan

Personal lendings. Some individual lendings are based upon credit score history, and also may not offer as much financing as small-business lendings. Household lendings. If relative are able, you might ask them to finance you cash for your company. Household financings can save you cash on interest, yet they need to still include a clear settlement strategy.Advertising considerations may affect where offers appear on the site but do not affect any editorial choices, such as which lending products we create about as well as exactly how we examine them. This website does not consist of all this link financing firms or all financing provides offered in the market.

Often, a bank loan is the answer to aid you attain your service objectives. Prior to you begin submitting applications, though, you'll wish to have a basic understanding of the bank loan landscape: what funding choices are available, which ones are popular, and also exactly how they work. In this overview, we'll cover those essentials and also some options worth considering.

Report this wiki page